We partnered with the CEO to develop the protocol dApp, and our collaboration has grown into an ongoing partnership, encompassing feature additions, landing page design, and more.

What we did

Branding UX/UI Design Product Management

Year completed

2023

Project

Unlocking Web3’s Global Potential

Umoja Protocol is a non-custodial, asset-hedging protocol engineered to automate hedging for diverse assets, such as crypto, fiat, and tokenized RWAs. Specifically developed for the $8 trillion emerging market MSME financing sector, it provides 100% security, blended hedging, natural risk mitigation, and hyper-default risk orientation.

Challenge

Crafting Pathways & Shaping Experiences

The project kicked off in the first days of 2023 with two exciting goals: (1) crafting a welcoming protocol landing page to showcase educational resources and ecosystem links and (2) designing user-friendly UX & UI for the protocol dApp interface.

Solutions

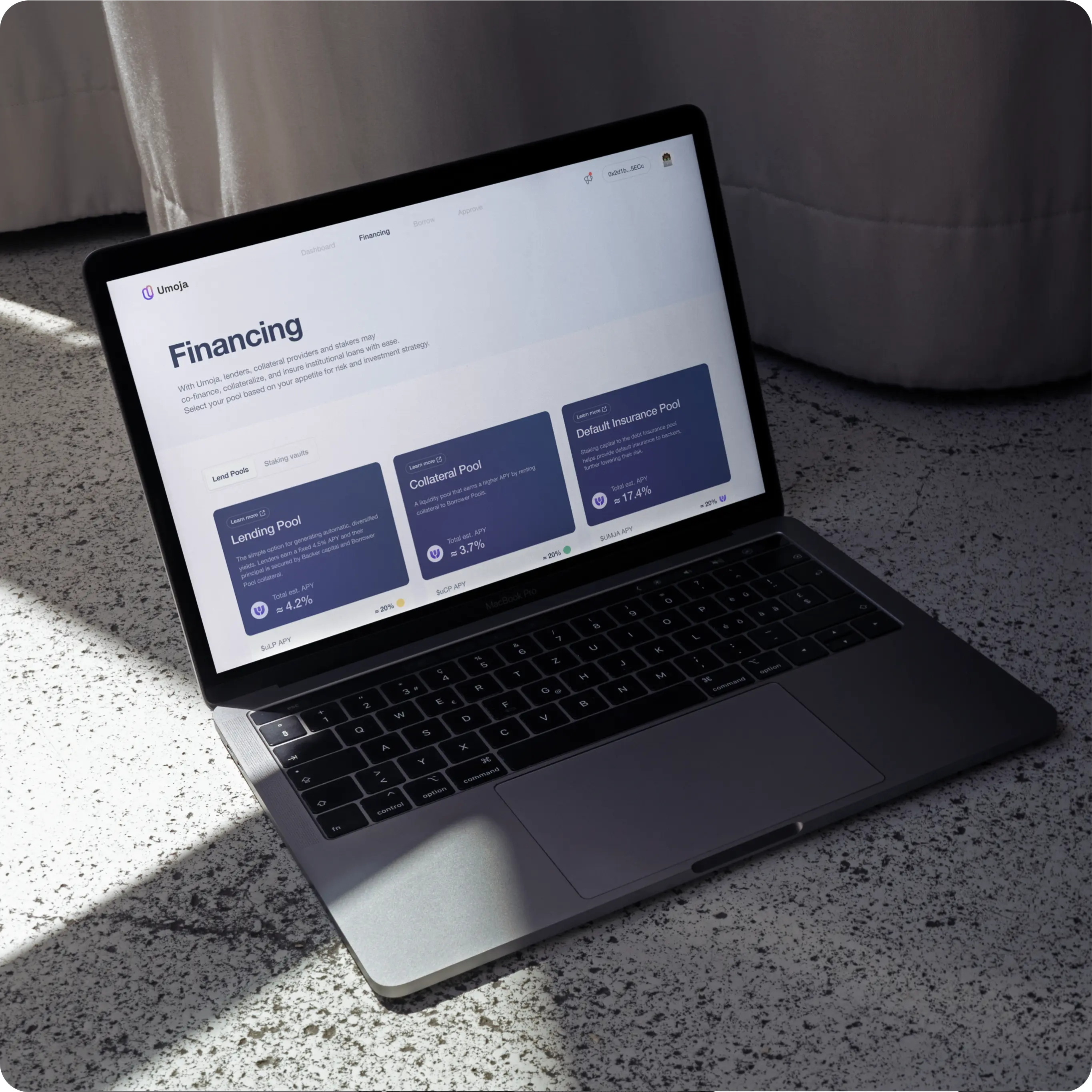

Navigating Finance with Style

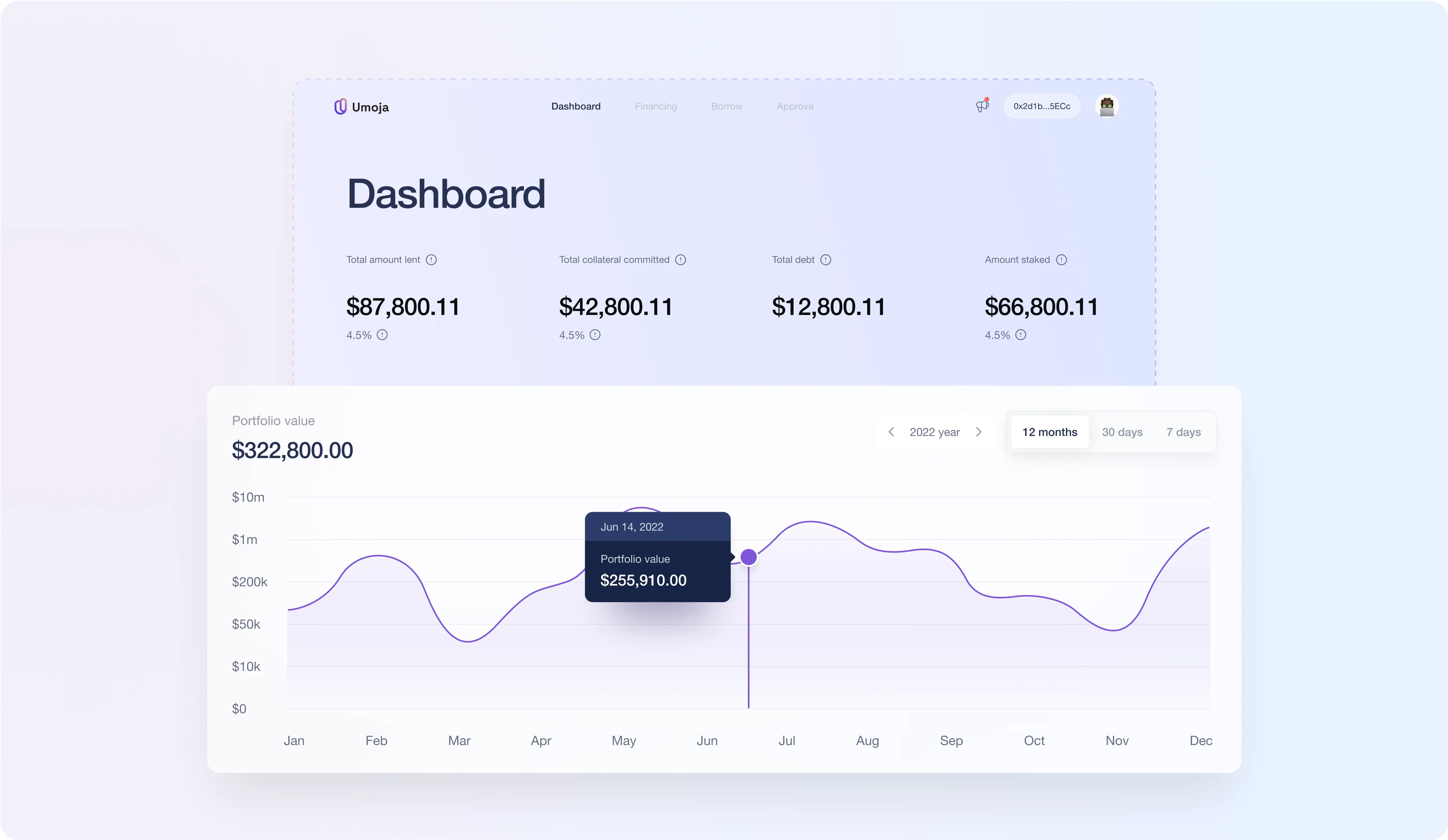

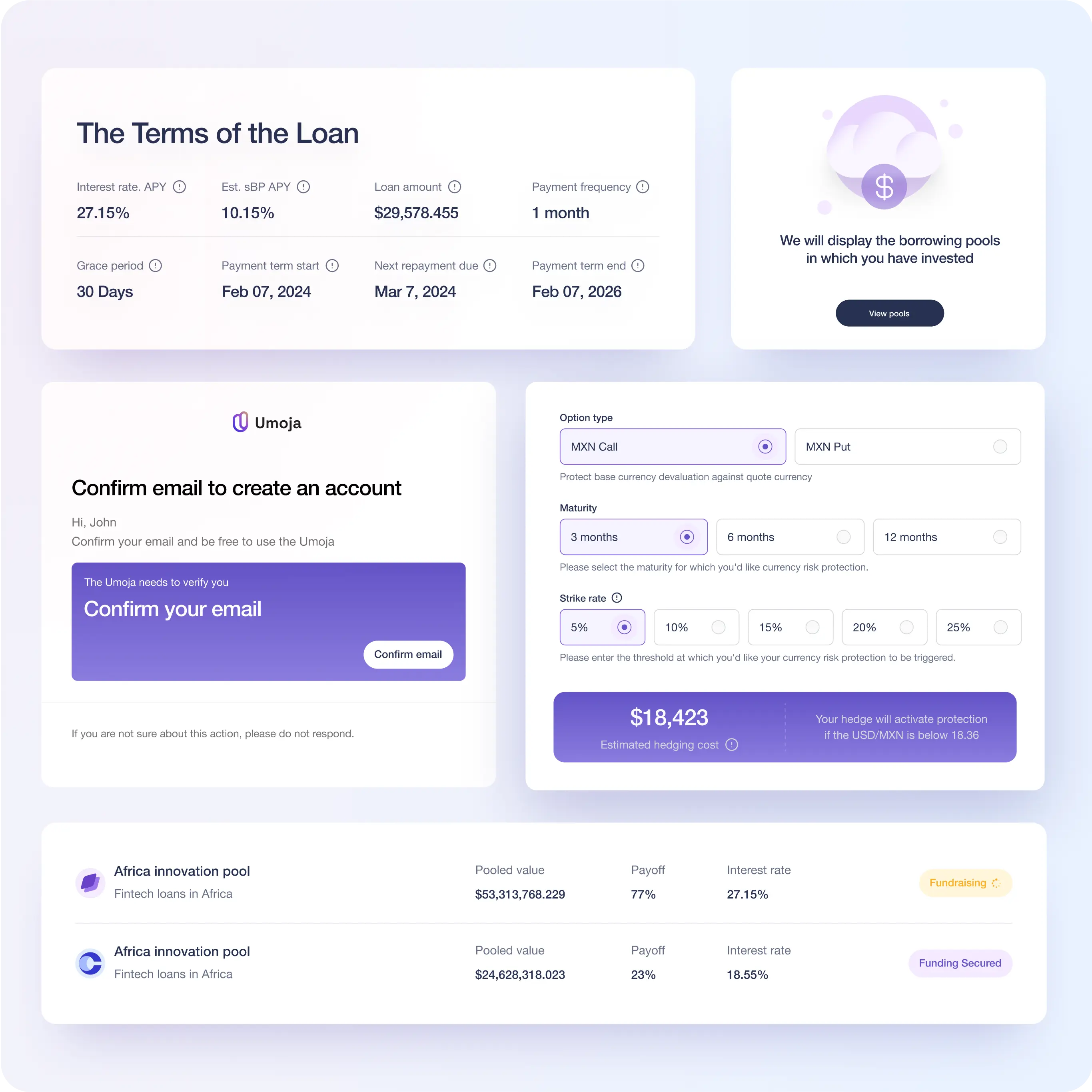

In a market saturated with financial products boasting intriguing branding, it became imperative for Umoja to distinguish itself and elevate its appeal. Recognizing finance as the core of Umoja, we advocated for interfaces exuding softness, trust, and warmth. Hence, our design concepts embodied this ethos, presenting not only the preferred style but also three additional options for client consideration.

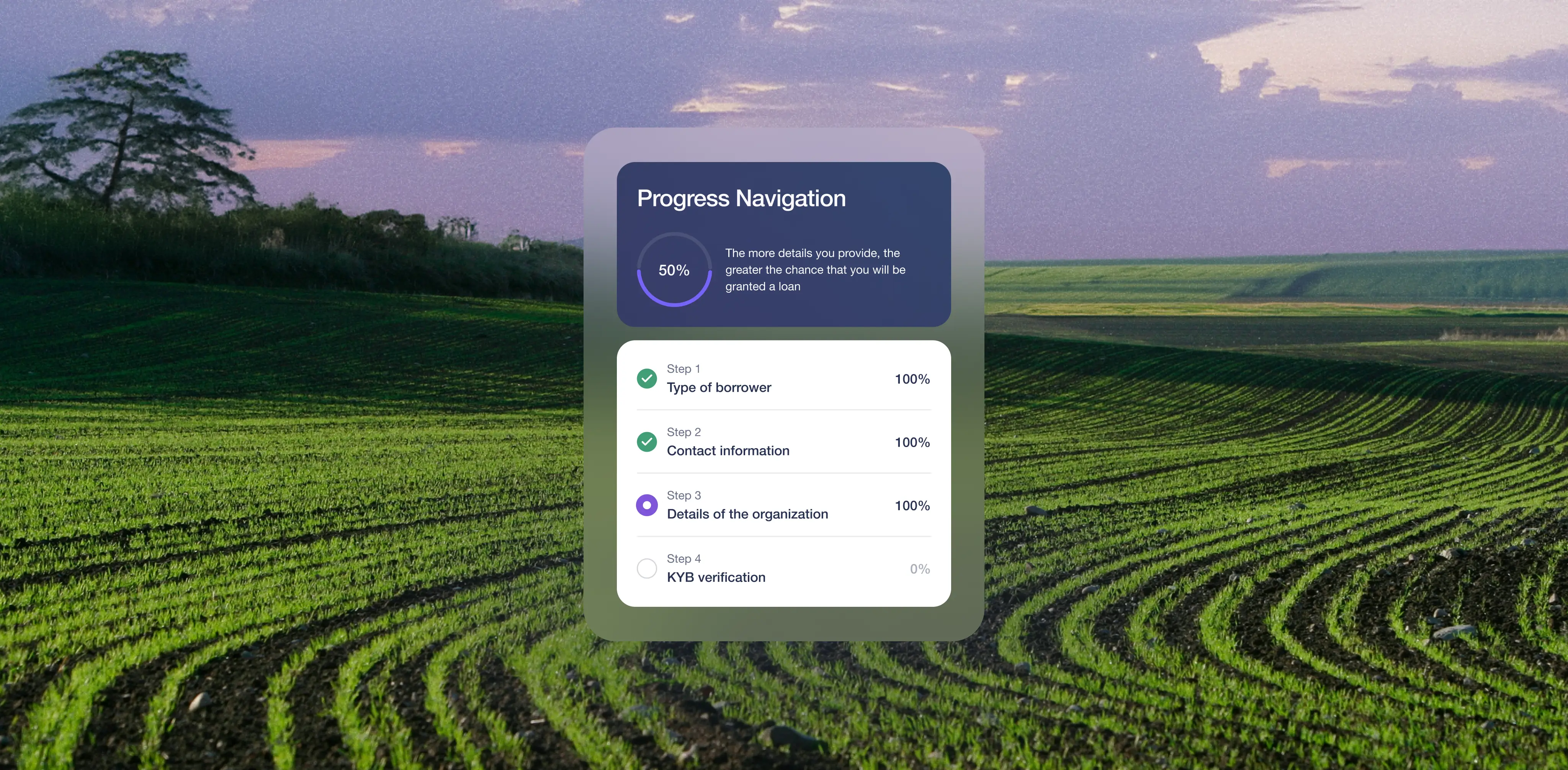

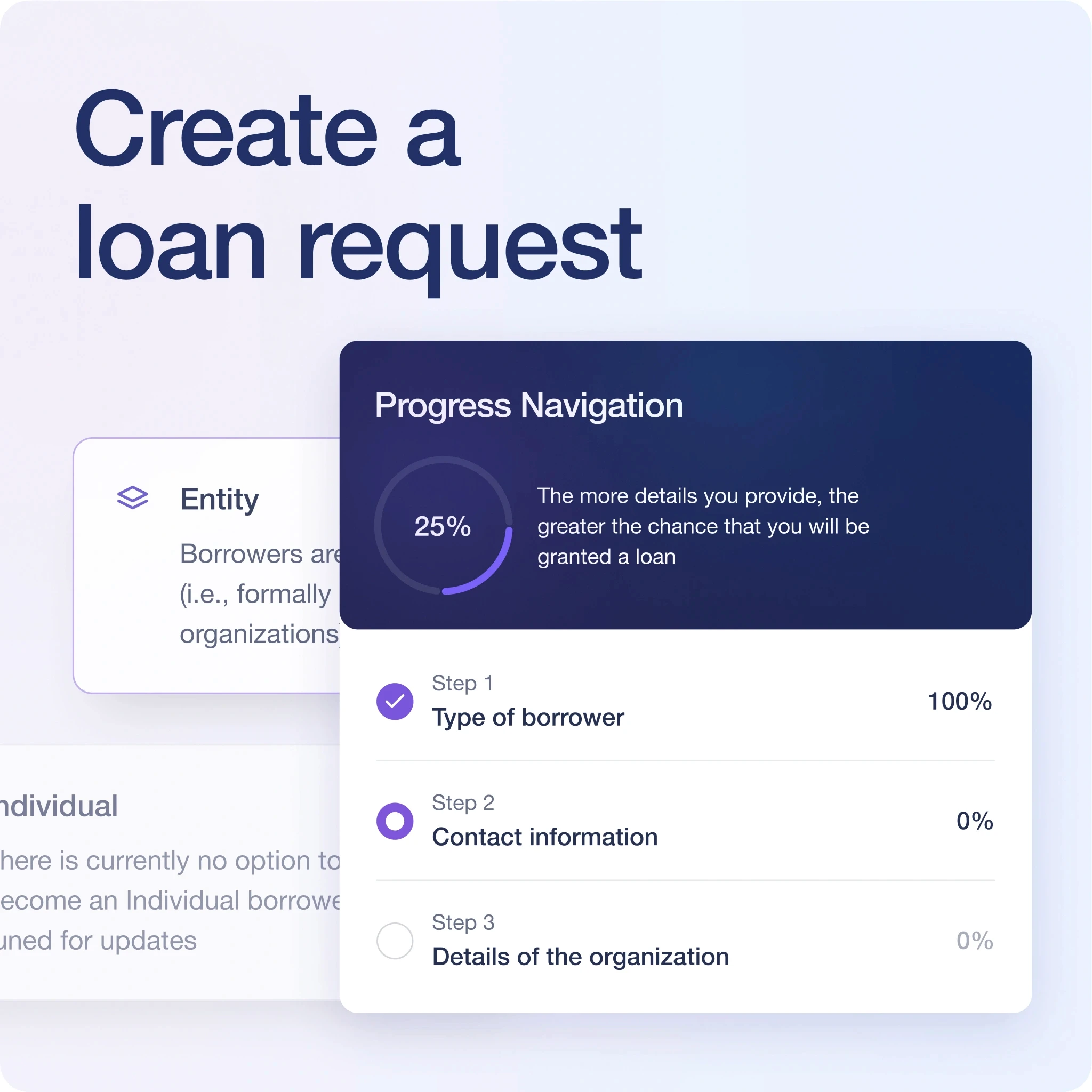

Simplified Borrower Journey

After examining competitors' “Become a Borrower” flow, we identified its inconvenience: a single input field and repetitive confirmation actions led to user frustration and uncertainty about progress. To streamline the process, we divided it into four clear steps, organized fields logically, and introduced a progress bar for user guidance. Additionally, we provided supportive text encouraging borrowers to input comprehensive data, improving their chances of loan approval.

“The project presented unique complexities — understanding its intricacies proved to be quite a puzzle due to the multitude of roles involved and the absence of competitor access.”

Artur Kogut

PRODUCT DESIGNER AT RASA DESIGN TEAM

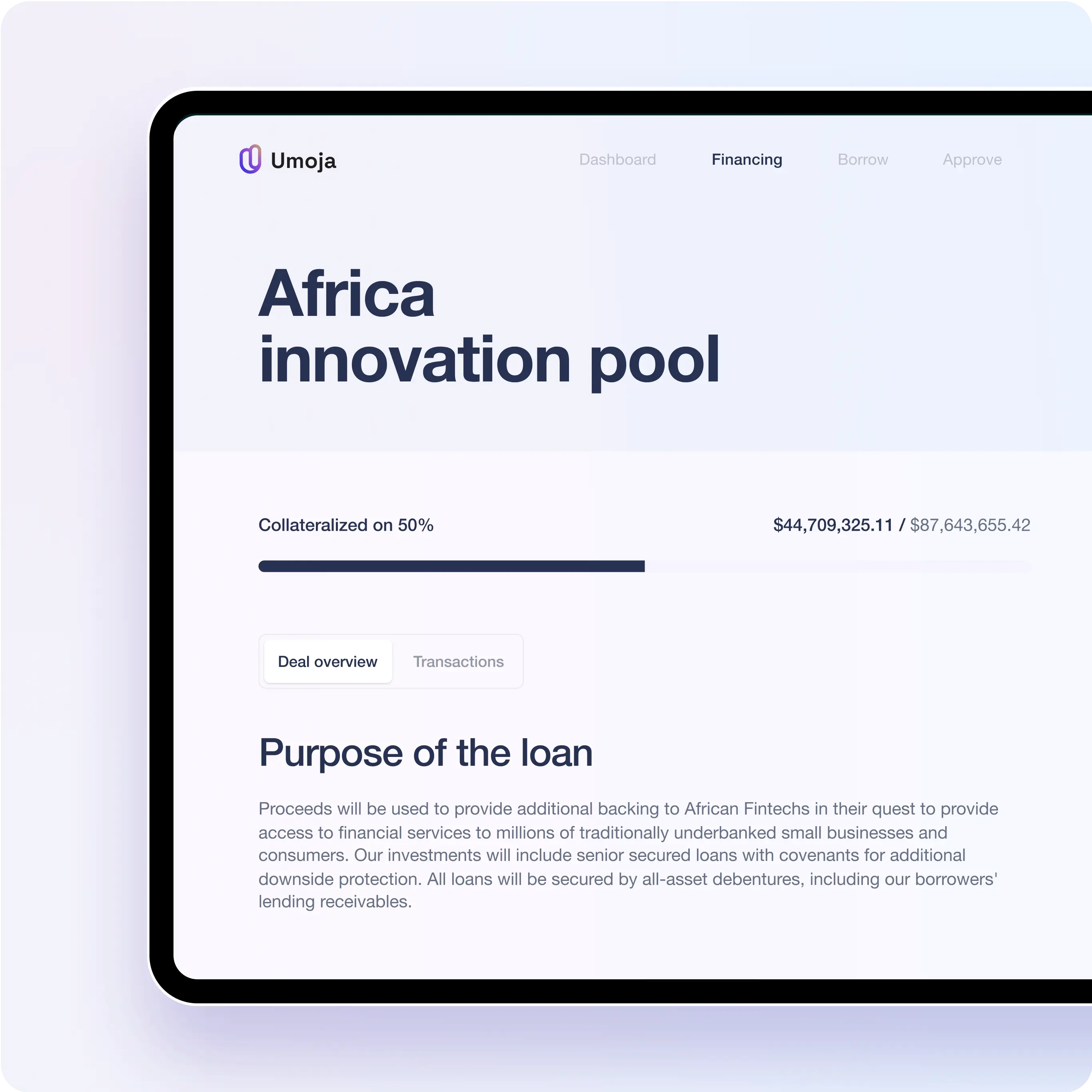

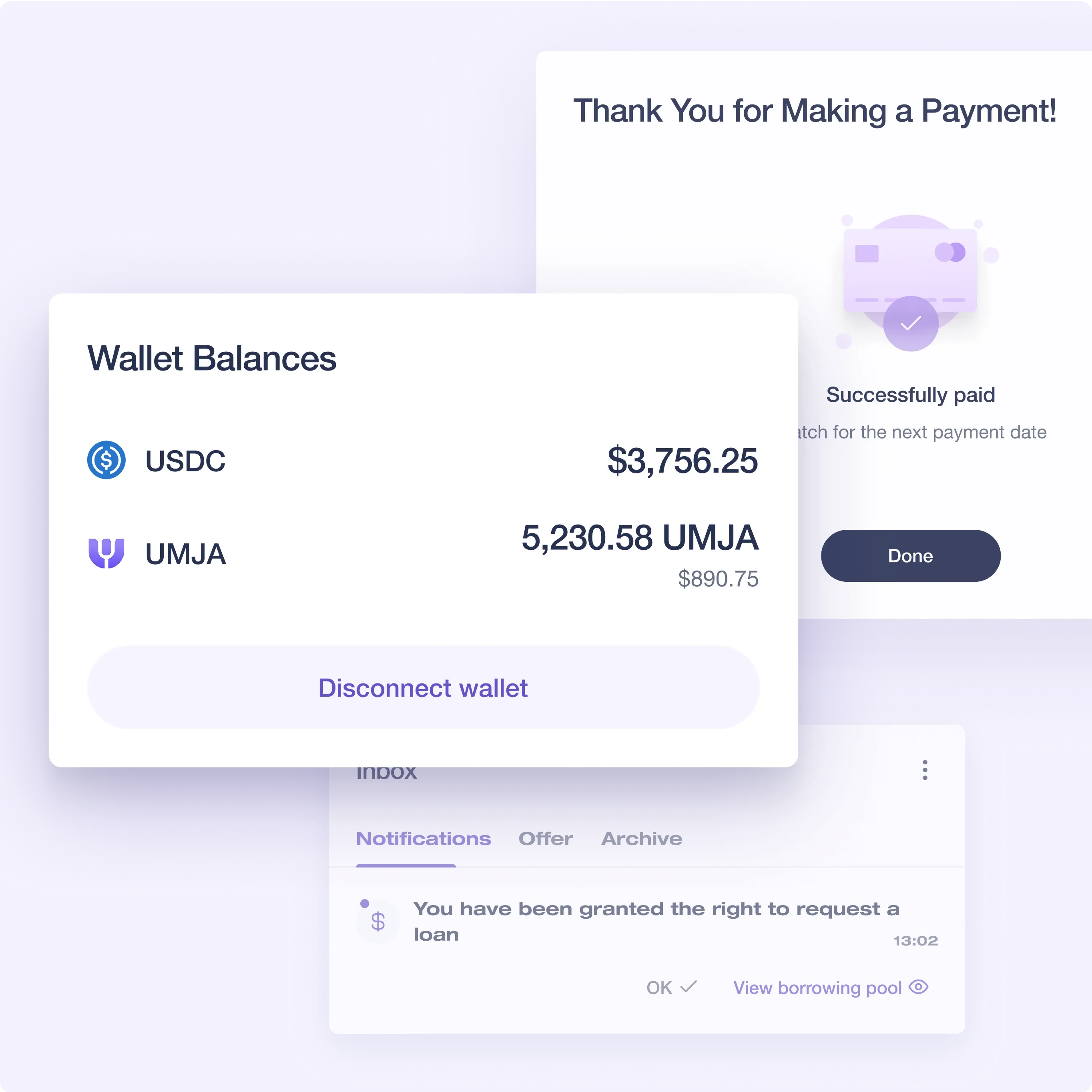

Streamlined Pool Structure for Clarity

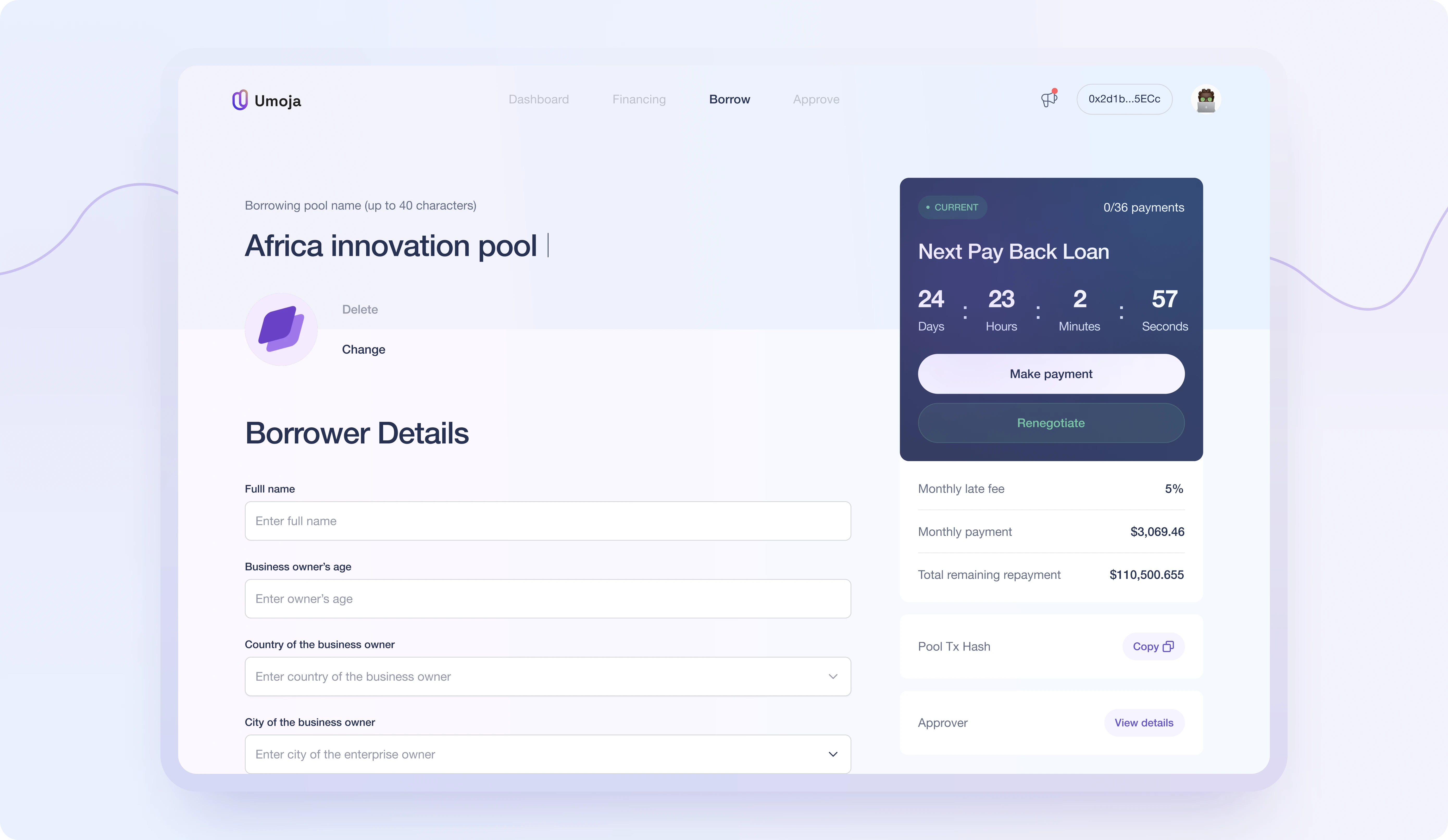

In our design strategy, we implemented a consistent pool structure, ensuring that a prominent card on the right always communicates the current status of specific processes. Whether it's a loan request, loan payment notification, or investment stage update, users can easily discern their position within the process flow. This standardized pattern enables users to intuitively access key information about each pool's stage, fostering familiarity and enhancing user experience.